Individualized financial and investment management

Mission Creek provides individualized wealth management, advisory and financial planning services for private clients

and sub-advisory services to other advisors and family offices. Our mission is to preserve, grow and perpetuate

our clients’ wealth by providing innovative financial planning and investment management solutions.

We employ a comprehensive and integrated financial planning and asset management approach to wealth management.

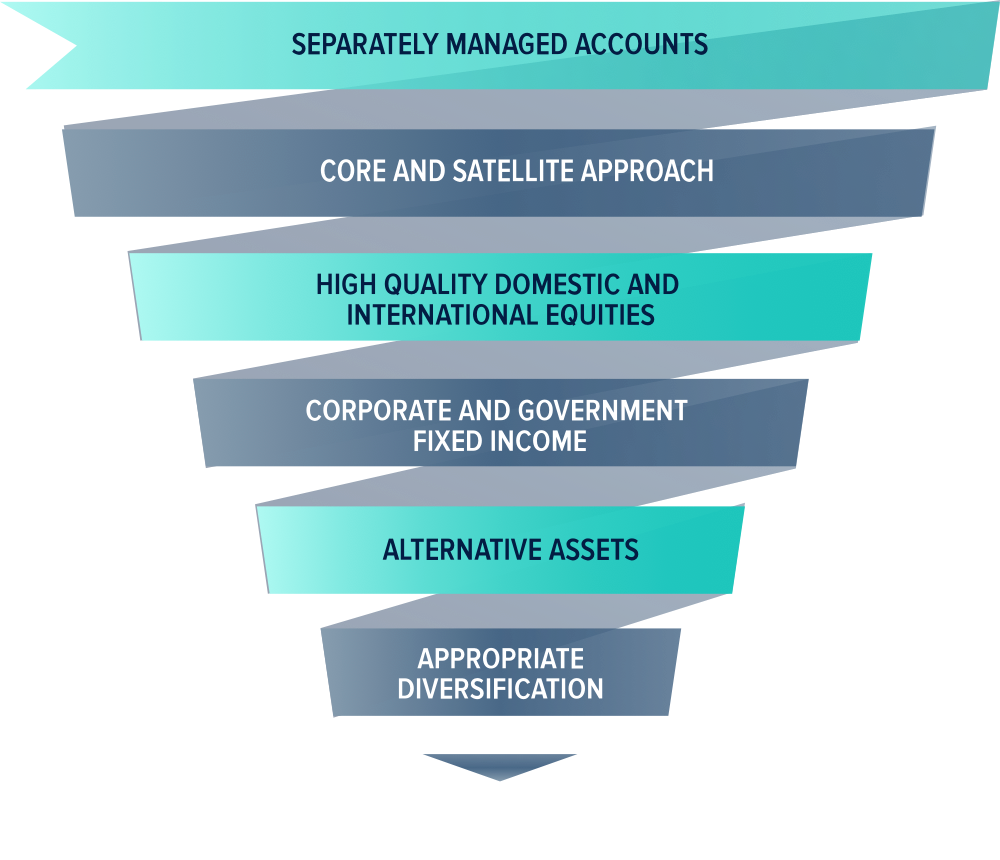

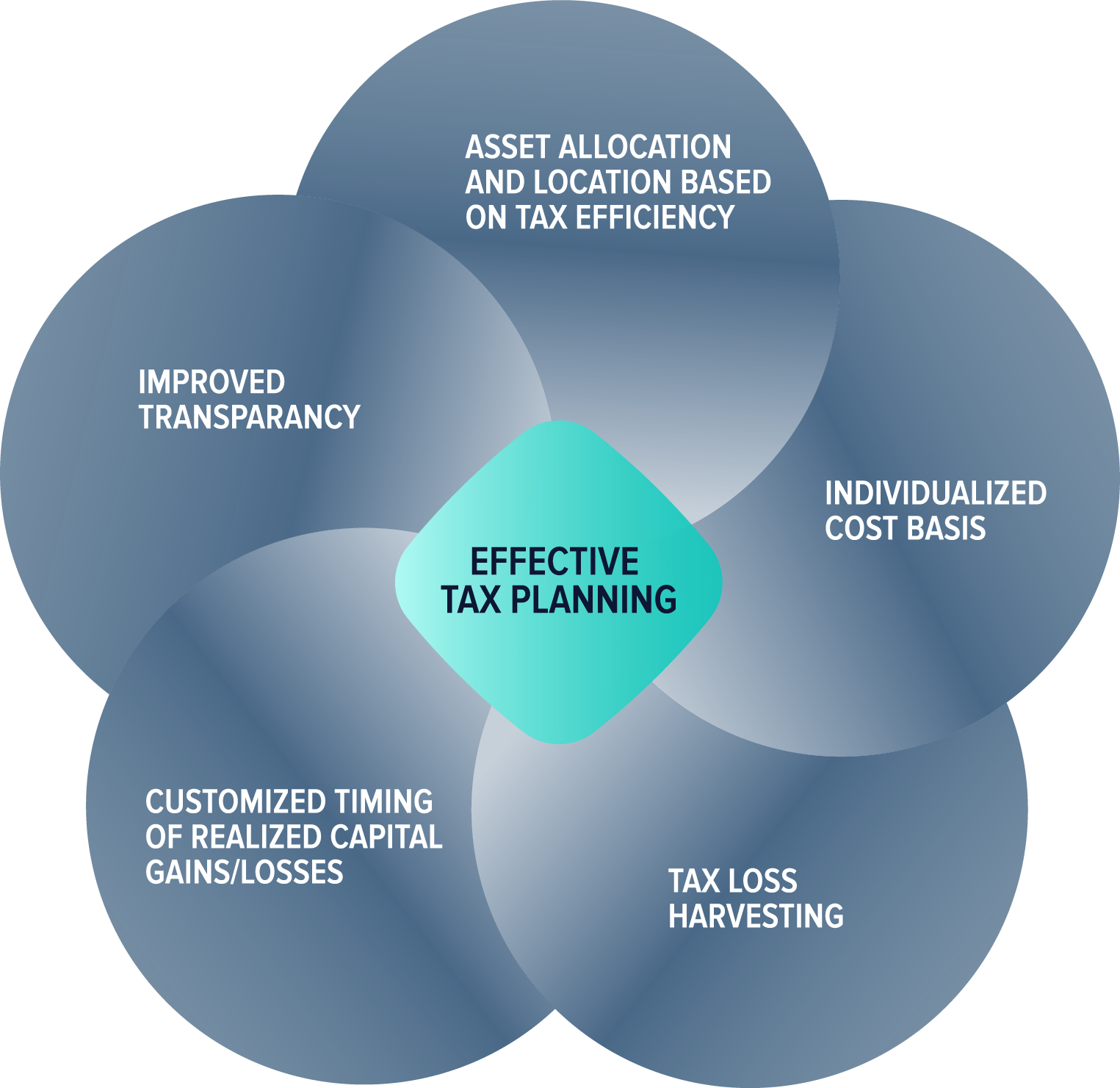

Our customized platform includes, along with Mission Creek’s separately managed account strategies, individualized

equity and fixed income investment strategies, option overlay strategies and, when suitable, access to alternative

investments. Mission Creek’s custom solutions include a comprehensive review of existing holdings to ensure a

streamlined and tax efficient transition, optimally aligned to our clients' individualized needs and objectives.

Contact us to learn more about our individualized financial planning and investment

management strategies and solutions.

As fiduciaries, we focus on implementing individualized solutions within

a completely unconflicted platform giving us the ability to always

be sitting on the same side of the table as our clients…

Ready to Get Started?

Affiliations and Certifications

We focus and specialize on the areas that matter most to helping

our clients succeed financially and otherwise…

Receive updates

from Mission Creek